Investing In Brassica & Beyond — Alternative Markets Infrastructure And Its Opportunities

Private markets have become increasingly complex as they have grown in scale, now expected to reach $24 trillion by 2026 and growing 20% annually, growing faster than public markets. This growth is partly because alternative assets have been outperforming traditional ones, and new asset classes continue to emerge and evolve.

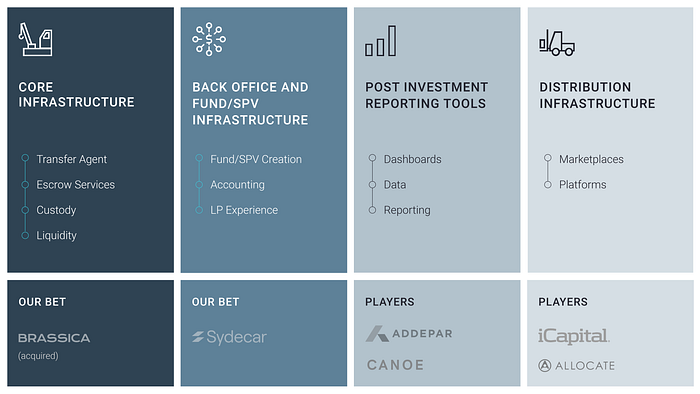

With a broadening base of investors diversifying their portfolios into alternative investments, these markets are drawing a wider and more varied group of participants. This diversification is a step toward achieving market efficiency by embracing a broader range of perspectives and investment strategies. Before we can fully realize this efficiency, a robust infrastructure is necessary, which, in our view, includes the following critical components:

Core infrastructure:

Efficiently managing the issuance, custody, transfer, and distribution of private securities

- Transfer Agent: Streamlining the management of private Reg A/CF shares issuance and transfers, accommodating restrictions and various accreditation levels.

- Escrow Services: Ensuring capital formation is secure, with a trusted third party holding funds or assets until all conditions are met.

- Custody: Providing secure custody for non-DTC securities through individual accounts.

- Liquidity: Improving liquidity with an Alternative Trading System that matches orders effectively.

Back office and fund/SPV infrastructure

Aiming to reduce the costs, legal, and regulatory hurdles involved in managing new investment vehicles and enhancing the LP onboarding process:

- Fund/SPV Creation: Making vehicle creation more straightforward by standardizing legal agreements, simplifying filings, and setting up funding accounts.

- Accounting: Modernizing and productizing the accounting process by automating wire reconciliation and the issuance of K1 forms.

- LP Experience: Ensuring a smooth and seamless experience for users from document signing to closing

Post investment reporting tools

Enhancing transparency and efficiency in monitoring and reporting on investments, as well as streamlining the calculation of Net Asset Value (NAV) and performance metrics

- Dashboards: Offering a unified platform for all post-investment reporting needs, enabling investors to get a comprehensive view of their portfolios.

- Data: Centralizing portfolio data and updates in a Bloomberg-like manner.

- Reporting: Streamlining the generation of detailed performance reports to track investment progress effectively.

Distribution Infrastructure

Making alternative investments more accessible across a broad spectrum of investors, thereby facilitating market efficiency and price discovery:

- Marketplaces: Matching demand with offer across retail and institutional investors, primary and secondary offerings, funds and individual opportunities

- Platforms: Enabling traditional financial institutions to offer alternative investments to their clientele with a B2BC approach

We are confident in the venture-scale potential for each of these infrastructure components. The recent acquisition of Brassica by Bitgo is an initial validation sign as a testament to our thesis:

Investing in Brassica

We invested a Core Check in Brassica’s Seed Round in March 2023, demonstrating our strong belief in its potential and its fit with our Core Infrastructure strategy.

As a newly founded company, our decision to back Brassica leaned heavily on the fact that Brassica’s team was exceptional. Their deep experience and history of success in the private markets make us confident in their ability to make a big impact in the industry.

Before Brassica, customers had to either create their own tools or use several fragmented services that only met single needs. Brassica’s vision as a ‘one-stop-shop’ for API-enabled infrastructure services, spanning transfer agent, escrow, and custody solutions, effectively filled a significant gap in the market. These services often used outdated systems, functioned more like traditional service businesses, lacked innovation, and were prone to expensive errors.

Brassica introduced a versatile solution catering to a broad audience, ranging from traditional RIAs and wealth management firms to forward-thinking funding platforms and crypto VCs.

The acquisition

Brassica was acquired by Bitgo in February 2024, 12 months after our Seed investment.

Bitgo offers secure and scalable wallet solutions for the digital asset economy, including regulated custody, staking, trading, and core wallet infrastructure to institutional clients. BitGo supports over 700 digital assets and serves more than 1,500 institutional clients in 50 countries.

With Brassica’s acquisition, Bitgo marks its entry into the private securities market, positioning itself as a comprehensive infrastructure provider for a wider range of asset classes, from digital to traditional private securities.

Before the acquisition, Brassica had achieved significant milestones, notably securing a Wyoming trust charter and actively servicing customers. The merger with BitGo was in our view strategic in nature. It will ultimately allow the companies to advance the digitization of the alternative asset industry in support of a financial services economy that is borderless and accessible 24/7, which ultimately was Brassica’s vision from the start.

The acquisition of Brassica further validates our thesis on the infrastructure of alternative markets, highlighting the market’s increasing demand for innovative and efficient solutions in this space.

Going forward

Our strategy remains focused on investing in the private markets, with the Brassica acquisition reinforcing the need for and impact of strong infrastructure. Moving forward, we are excited to back exceptional teams developing the building blocks of a more robust private market ecosystem. We envision these teams as combining a mix of solid regulatory and financial securities knowledge, as well as engineering skills. These teams need to be able to weave regulatory demands seamlessly into the product’s framework.

We are cautious of service-style businesses promising future technology infrastructure while primarily depending on manual processes, which undermines margins and economies of scale. Such approaches seem unlikely to enable these companies to achieve venture-scale outcomes.

We continue to monitor regulatory changes in the private markets and their effects on creating a need for new products and services, as well increasing marketability and accessibility by different participants.

We are confident that, with the right infrastructure and distribution channels, accessing alternatives will become as easy as placing a trade through a brokerage account in the future. While this will increase the asset class’s accessibility to retail-like investors, we believe most of the AUM will be captured via institutional partnerships with banks and RIAs, which will in turn distribute the underlying to their clients according to their risk profiles.

With this vision in mind, we are particularly excited to support companies that develop tools to facilitate incumbent interaction with private markets, with a focus on the infrastructure, reporting, aggregation, and distribution layers. RIAs, family offices, HNW individuals, wirehouses and banks all have different ways to engage with the private markets — specific tools will need to be developed to cater to the unique needs of each of these types of investors.

Shout-outs to Adam Hardej and Chris Wallace for their help reviewing this post.